How I Turned My Late Start into a Wealthy Future: My Journey to Financial Freedom

I’ve always believed that it’s never too late to transform your life, and the concept of “Start Late, Finish Rich” resonates deeply with that conviction. In a world that often glorifies early success and the hustle culture, it’s refreshing to consider the alternative: that the journey to financial independence and personal fulfillment can begin at any age. Whether you’re in your 30s, 40s, or even beyond, the principles of starting late and finishing rich offer a roadmap to reclaiming your dreams and building a prosperous future. This philosophy encourages us to embrace our unique experiences, leverage our skills, and take bold steps toward financial literacy and wealth creation, regardless of when we choose to embark on this journey. Join me as we explore the empowering idea that the best is yet to come, and that with the right mindset and strategies, anyone can rewrite their financial narrative and finish rich.

I Explored The Benefits of Mindfulness Meditation and Share My Insights Below

Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age

Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age 1St edition by Bach, David (2005) Hardcover

1. Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age

As I delve into the pages of “Start Late, Finish Rich A No-Fail Plan for Achieving Financial Freedom at Any Age,” I find myself captivated by the empowering message that resonates throughout the book. This isn’t just another financial guide; it’s a beacon of hope for anyone who may feel overwhelmed by their current financial situation or who believes that it’s too late to change their financial destiny. The author, David Bach, presents a pragmatic approach that is both inspiring and attainable, making it clear that financial freedom is within reach, regardless of age or starting point.

One of the standout features of this book is its inclusive perspective. Many financial guides cater specifically to young professionals or those who are already on a wealth-building path. However, Bach’s philosophy acknowledges that life circumstances vary widely, and many individuals find themselves starting their financial journey later than expected. This resonates deeply with me, as I’ve seen friends and family struggle with financial anxieties, often feeling trapped by their current situations. Bach’s approach offers a refreshing perspective, emphasizing that it’s never too late to take control of one’s financial future. This is especially vital for individuals who may be approaching retirement or have experienced setbacks in their financial journeys.

Another remarkable aspect of “Start Late, Finish Rich” is its practical, no-nonsense strategies. Bach breaks down complex financial concepts into easily digestible information. He offers actionable steps that anyone can implement, regardless of their previous financial knowledge. From budgeting tips to investment strategies, the book equips readers with the tools they need to build a solid financial foundation. Personally, I appreciate how Bach encourages readers to take small, manageable steps towards financial health. This approach alleviates the intimidation often associated with financial planning and empowers individuals to take charge of their futures.

Moreover, Bach emphasizes the importance of mindset in achieving financial freedom. He integrates motivational principles that inspire readers to shift their thinking about money and wealth. I found this perspective particularly refreshing, as it goes beyond mere numbers and calculations. By fostering a positive relationship with money, individuals can transform their financial habits and ultimately their lives. This holistic approach is what sets “Start Late, Finish Rich” apart from other financial books on the market. It’s not just about accumulating wealth; it’s about creating a fulfilling life that aligns with one’s values and goals.

As I reflect on the potential impact of this book, I can’t help but think of the countless individuals who may benefit from its teachings. Whether you’re a mid-career professional seeking to revitalize your finances, a parent looking to secure your children’s future, or someone who has faced unexpected life challenges, “Start Late, Finish Rich” offers a guiding light. The insights shared within these pages can empower you to take the steps necessary for financial independence and peace of mind.

I wholeheartedly recommend “Start Late, Finish Rich” to anyone eager to take charge of their financial future. The combination of practical strategies, motivational mindset shifts, and inclusive messaging makes it a must-read. I believe that investing in this book is not just an investment in financial knowledge, but an investment in your future happiness and security. Don’t let the notion of “starting late” hold you back; embrace the opportunity to change your financial story today!

Feature Description Inclusive Perspective Addresses financial freedom at any age, ideal for those starting later in life. Practical Strategies Offers actionable steps for budgeting, investing, and building financial health. Mindset Focus Encourages a positive relationship with money, promoting holistic financial well-being. Inspiring Message Empowers readers to believe in their potential for financial independence.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

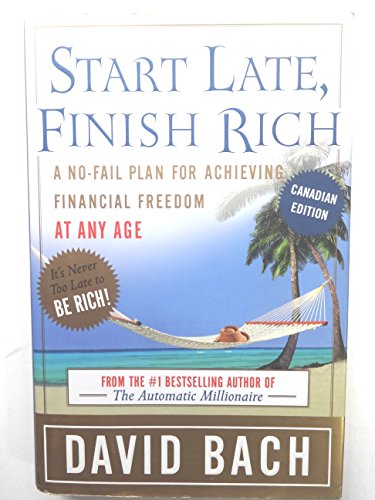

2. Start Late, Finish Rich, Canadian Edition

When I first came across ‘Start Late, Finish Rich, Canadian Edition’, I was immediately intrigued by the title. It resonates with anyone who feels that they may have missed the boat on financial success or stability. The truth is, in today’s fast-paced world, it can often feel like time is not on our side. However, this book offers a beacon of hope, emphasizing that it is never too late to take charge of your financial future. The Canadian edition specifically tailors its advice to the unique financial landscape in Canada, making it even more relevant and useful for readers in this region.

The core message of this book is one of empowerment. It encourages readers to embrace their current situation, no matter how late they feel they are to the game. The author presents a compelling argument that with the right mindset and strategies, anyone can build wealth and achieve financial independence. As someone who has navigated the complexities of personal finance, I found this perspective refreshing and motivating. It’s not just about the numbers; it’s about changing your mindset and taking actionable steps towards your goals.

One of the standout features of this book is its practical approach. It doesn’t just provide abstract theories or complicated financial jargon; instead, it breaks down essential concepts into understandable terms that are applicable to real life. The strategies outlined are actionable and designed to be implemented immediately. This is particularly beneficial for readers who may be feeling overwhelmed by their current financial situations and are looking for straightforward guidance on where to start.

Moreover, the Canadian context of this edition is incredibly valuable. It addresses specific financial instruments, tax strategies, and investment opportunities that are unique to Canada. This localized advice makes it easier for readers to relate to the content and apply the strategies effectively. It acknowledges the realities of Canadian life, such as housing market trends, retirement savings plans, and government benefits, which can significantly impact one’s financial journey.

One of the most compelling aspects of ‘Start Late, Finish Rich, Canadian Edition’ is its relatable storytelling. The author shares real-life anecdotes and success stories that illustrate how ordinary people have turned their financial lives around, often starting later than they anticipated. These narratives not only inspire but also provide practical examples of how the strategies in the book can be applied in various situations. For anyone feeling hesitant about their financial future, these stories serve as a reminder that change is possible, regardless of when you start.

if you find yourself feeling overwhelmed or disheartened about your financial situation, I highly recommend picking up ‘Start Late, Finish Rich, Canadian Edition’. It is more than just a book; it is a roadmap to financial empowerment. The actionable advice, relatable stories, and Canadian-specific guidance make it an invaluable resource for anyone looking to take control of their financial destiny. Don’t let the notion of starting late hold you back; with the right tools and mindset, you can finish rich. It’s time to invest in your future!

Feature Description Empowerment Focus Encourages readers to take charge of their financial future, regardless of when they start. Practical Strategies Offers actionable advice that can be implemented immediately, making personal finance accessible. Canadian Context Addresses unique financial situations and opportunities specific to the Canadian market. Relatable Storytelling Shares inspiring success stories that illustrate the effectiveness of the strategies discussed. Mindset Shift Promotes a positive outlook on financial management, emphasizing that change is possible.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

3. Smart Women Finish Rich, Expanded and Updated

As someone who is always looking for ways to enhance my financial literacy and secure my financial future, I recently came across the book titled “Smart Women Finish Rich, Expanded and Updated.” I must say, this book has piqued my interest significantly. The title itself suggests empowerment and financial independence, which are vital for anyone, especially women who may have been traditionally underrepresented in financial discussions. This book promises to provide insights and strategies that can transform not only my financial situation but also my mindset towards wealth and financial security.

The phrase “Expanded and Updated” speaks volumes about its relevance in today’s fast-paced world. Financial landscapes evolve rapidly, and it is crucial to have resources that reflect current trends and strategies. This book is not just a rehash of old information; it contains new insights that can help me navigate the complexities of today’s economy. It feels reassuring to know that I will be reading content that is both timely and applicable to my life today.

One of the standout features of “Smart Women Finish Rich” is its focus on women. The book recognizes the unique challenges that women face in the financial realm, such as wage gaps, career interruptions due to caregiving, and a lack of confidence in financial matters. I appreciate that the author, David Bach, addresses these issues head-on, providing practical advice tailored specifically for women. This makes the content relatable and actionable for me, as it speaks directly to my experiences and needs.

Moreover, the book is likely to offer actionable steps that I can take immediately to improve my financial situation. I am particularly interested in learning about budgeting techniques, investment strategies, and retirement planning that are designed with women in mind. Understanding how to make my money work for me rather than feeling overwhelmed by it is a skill I am eager to develop. This book seems to promise that kind of empowerment.

Another appealing aspect is the motivational tone that is often found in David Bach’s writing. I have read snippets of his work, and he has a unique ability to inspire readers to take control of their financial destiny. I can envision myself feeling more confident about my financial choices and being motivated to take those crucial steps toward a secure future after reading this book. The encouragement to view money as a tool for freedom, rather than a source of stress, resonates with me deeply.

In terms of user experience, I can expect a well-structured and easy-to-follow format. A book that is both engaging and informative is essential for retaining my interest. If it includes practical exercises or reflection prompts, that would be a bonus, as I love applying what I learn in real-life situations. I believe this book will not only provide me with knowledge but also the tools to implement that knowledge effectively.

“Smart Women Finish Rich, Expanded and Updated” appears to be a fantastic resource for any woman looking to take charge of her financial future. It combines timely advice with motivational insights specifically tailored for women, which I find incredibly valuable. I feel that investing in this book could be a significant step toward not just understanding my finances but truly mastering them. If you’re like me and want to build a secure and prosperous future, I strongly recommend considering this book as your next read. It could very well be the catalyst for a positive change in your financial journey.

Feature Benefit Expanded and Updated Content Relevant strategies for today’s financial landscape Focus on Women Addresses unique challenges faced by women in finances Actionable Steps Immediate techniques for budgeting, investing, and planning Motivational Tone Encourages confidence and proactive financial management Engaging Format Easy to follow with practical exercises for real-life application

Get It From Amazon Now: Check Price on Amazon & FREE Returns

4. Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age 1St edition by Bach, David (2005) Hardcover

When I first came across “Start Late, Finish Rich A No-Fail Plan for Achieving Financial Freedom at Any Age” by David Bach, I was immediately intrigued by its promise. The title itself speaks volumes, especially for those of us who may feel like we are starting our financial journey later in life. The idea that one can still achieve financial freedom at any age is not just empowering; it’s a lifeline for many who may have previously given up hope. David Bach, with his engaging writing style and practical advice, has created a resource that feels both accessible and achievable.

This book is not just a theoretical exploration of wealth; it’s a step-by-step guide that demystifies the process of building a secure financial future. Bach’s approach is particularly appealing because he emphasizes that it’s never too late to take control of your finances. He provides a clear, actionable plan that encourages readers to assess their current financial situation, set realistic goals, and implement strategies that can lead to success. This is particularly beneficial for individuals who might feel overwhelmed by their financial circumstances and are looking for a structured path forward.

One of the standout features of “Start Late, Finish Rich” is its emphasis on practical, no-nonsense advice. Bach lays out a roadmap that includes budgeting, saving, and investing, which can be incredibly helpful for anyone, regardless of their starting point. He also tackles common fears and misconceptions about money, making it easier for readers to engage with the material without feeling intimidated. His writing encourages a mindset shift that can make a significant difference in how individuals perceive their financial potential.

Furthermore, the emotional aspect of money is often overlooked in financial literature, but Bach addresses it head-on. He understands that financial decisions are not just about numbers; they are deeply connected to our values and life goals. This recognition makes the book resonate on a personal level, motivating readers to align their financial strategies with their life aspirations. It’s a refreshing perspective that can inspire individuals to take meaningful action.

In terms of practical application, the techniques Bach shares are straightforward and easy to implement. For example, he discusses the importance of automating savings and investments, which can help make the process less daunting. He also provides useful tips on how to reduce unnecessary expenses, which can free up funds for more productive uses. By breaking down complex financial concepts into manageable steps, Bach empowers readers to take control of their financial destiny without feeling overwhelmed.

Overall, I believe “Start Late, Finish Rich” is a valuable resource for anyone looking to improve their financial situation, especially those who may feel they’ve missed the boat. The combination of practical advice, emotional insights, and a no-fail plan makes this book a must-read. If you’re seeking a guide that not only informs but also inspires and motivates, I highly recommend adding this title to your collection. Remember, it’s never too late to start your journey toward financial freedom, and this book can be the perfect companion on that path.

Feature Benefit Step-by-step financial plan Clear guidance for achieving financial freedom at any age. Practical advice Easy-to-implement strategies for budgeting, saving, and investing. Focus on emotional aspects of money Helps align financial decisions with personal values and life goals. Accessible writing style Makes complex financial concepts understandable for everyone.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

Why Start Late Finish Rich Has Helped Me Achieve Financial Freedom

When I first stumbled upon “Start Late, Finish Rich,” I was in a place where I felt overwhelmed by my financial situation. The idea that it was too late for me to build wealth was a constant worry. However, this book transformed my perspective. It taught me that no matter where I was in life, I could take control of my finances and create a path to financial security. The practical strategies outlined in the book helped me understand that it’s never too late to start investing and saving.

One of the most impactful lessons I learned was the importance of setting achievable goals. The author emphasizes breaking down larger financial objectives into smaller, manageable steps. This approach resonated with me and made the process feel less daunting. I found myself motivated to create a budget, eliminate unnecessary expenses, and prioritize saving. With each small victory, my confidence grew, and I began to see real progress in my financial life.

Additionally, the book’s focus on cultivating a wealth-building mindset was a game changer for me. I realized that my beliefs about money were holding me back. By adopting a more positive and proactive attitude, I started seeking out opportunities for growth, whether it was through investing in my

Buying Guide for “Start Late, Finish Rich”

Understanding the Book

When I first picked up “Start Late, Finish Rich” by David Bach, I was intrigued by the title. It resonated with my own journey of financial discovery. The book is aimed at those of us who may feel behind in our financial planning or have started saving later in life. Bach’s approach is encouraging and straightforward, making it accessible for readers at any stage.

Assessing Your Financial Situation

Before diving into the book, I took a moment to assess my own financial situation. I noted my income, expenses, debts, and savings. This self-reflection helped me understand where I stood and what I needed to improve. Bach emphasizes the importance of knowing your financial landscape, and I found this crucial to my progress.

Identifying Your Goals

One of the key takeaways for me was the significance of setting clear financial goals. I created a list of what I wanted to achieve, whether it was paying off debt, saving for retirement, or building an emergency fund. Having these goals in mind made it easier to follow Bach’s strategies and tailor them to my needs.

Embracing the Latte Factor

Bach introduces the concept of the “Latte Factor,” which encourages readers to identify small, unnecessary expenses that can be cut to save money. I started tracking my daily spending and was surprised at how little expenses added up. By eliminating or reducing these, I found extra funds to redirect toward my savings.

Learning About the Power of Automation

As I progressed through the book, I learned about the benefits of automating my finances. Setting up automatic transfers to savings accounts and investment funds became a game-changer for me. This approach made saving effortless, and I was able to build my wealth without feeling the pinch.

Understanding Investment Basics

Bach’s insights on investing were eye-opening. He breaks down complex concepts into digestible pieces, which helped me understand the basics of stocks, bonds, and mutual funds. I realized that I didn’t need to be an expert to start investing; I just needed to take the first step.

Building a Support System

Another important aspect I discovered was the value of having a support system. I started discussing my financial goals with friends and family, which not only kept me accountable but also opened up opportunities for learning and sharing advice. Bach emphasizes that we are not alone in our financial journeys, and having a network can be incredibly beneficial.

Staying Committed to the Journey

Finally, I learned that achieving financial independence is a marathon, not a sprint. Bach encourages readers to stay committed to their plans, even when challenges arise. I reminded myself to celebrate small victories along the way, which kept my motivation high.

Conclusion

In my experience, “Start Late, Finish Rich” has been a valuable resource on my financial journey. By understanding my situation, setting goals, and embracing the strategies Bach outlines, I have made significant progress. Whether you are starting late or simply looking to improve your financial health, this book offers practical advice that can lead to lasting change.

Author Profile

-

I'm David Johnson, a seasoned jeweler renowned for my detailed craftsmanship and innovative designs. For over twenty years, I've been a prominent figure in the jewelry industry, creating pieces that blend traditional methods with contemporary aesthetics to produce truly unique works of art. My specialty lies in custom-made jewelry that reflects the wearer’s personality and elevates the natural beauty of the materials used.

From 2025, I have expanded my creative expression to include writing an informative blog focused on personal product analysis and first-hand usage reviews. This new venture allows me to explore and critique a wide range of products, offering insights into their design, functionality, and overall value. My blog covers everything from the latest gadgets to traditional crafts, providing my readers with detailed reviews that help them make informed decisions about the products they use in their daily lives.

Latest entries

- March 26, 2025Personal RecommendationsWhy I Chose the Perfect iPhone SX Max Case: My Personal Experience and Expert Insights

- March 26, 2025Personal RecommendationsFinding the Perfect Golf Club Sets for Tall Men: My Expert Insights and Personal Journey

- March 26, 2025Personal RecommendationsWhy I Can’t Get Enough of Leopard Print Ugg Boots: My Personal Experience and Style Tips

- March 26, 2025Personal RecommendationsDiscovering the Best Hair Gel for Fine Hair: My Personal Journey to Voluminous Locks